What questions should we ask? It depends on our goals.

- Do we need to understand overall trends in our customer satisfaction over time?

- Do we need to identify customer service issues that frustrate customers?

- Do we need to uncover product issues to improve our product?

In the following sections, we’ll uncover best practices for all scenarios.

1. Understanding overall trends in customer satisfaction over time

To identify overall trends in customer satisfaction, we first have to get a benchmark on how happy (or unhappy) our customers are today. Then we can ask the same question at set intervals to understand how our customer satisfaction changes over time. This will help us identify trends and solve new customer issues.

The most popular ways to measure overall customer satisfaction trends are:

- Net Promoter Score (NPS)

- Customer Satisfaction Score (CSAT)

- Social media monitoring

Let’s break down the pros and cons of each option.

a) Net Promoter Score (NPS)

Net Promoter Score (NPS) is growing in popularity for measuring the likelihood a person will recommend your product or service. It’s one question with a scale of 1 to 10:

Not gathering feedback today? Learn more about HubSpot Service Hub’s customer feedback tool.

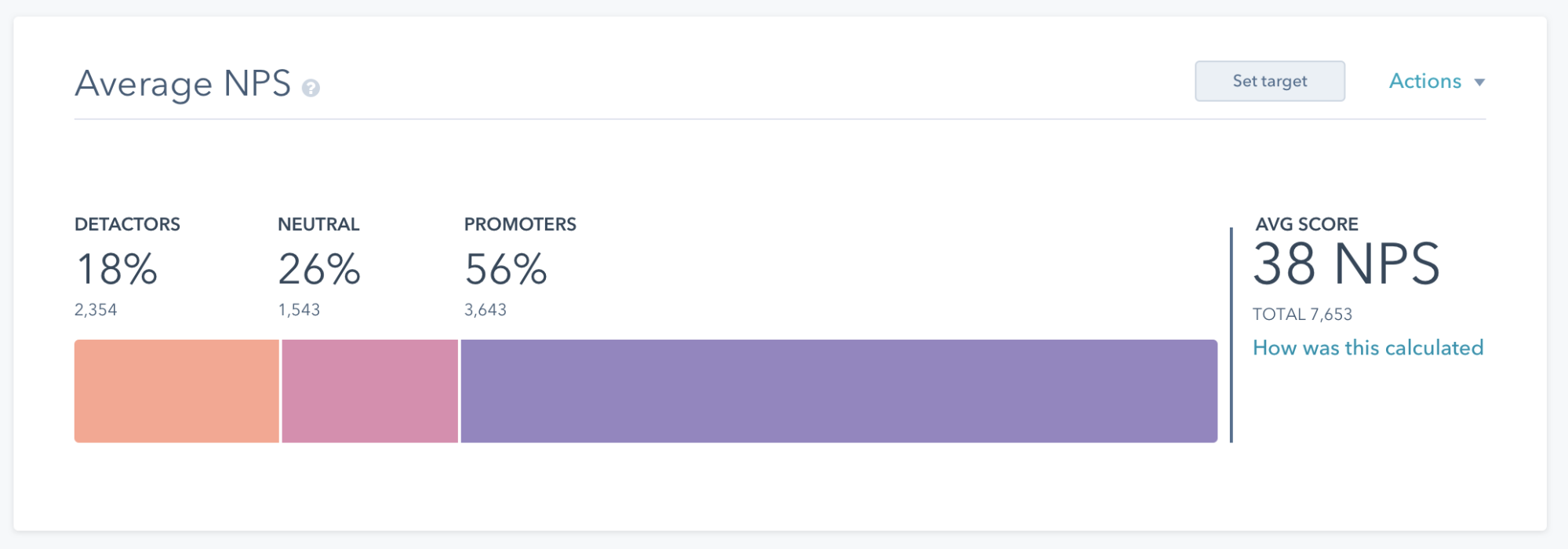

NPS is calculated by subtracting the percentage of detractors (customers who would not recommend you) from the percentage of promoters (customers who would recommend you). It’s commonly used as a tactic for measuring customer loyalty. In fact, customers who fall into the “promoter” category tend to have a customer lifetime value (LTV) that’s 600% – 1400% higher than those in the “detractor” category.

In addition, according to data from Bain and Company, companies with the highest NPS in their industry tend to outgrow their competitors by at least 2x.

Here are the pros and cons of using NPS:

|

|

b) Customer Satisfaction Score (CSAT)

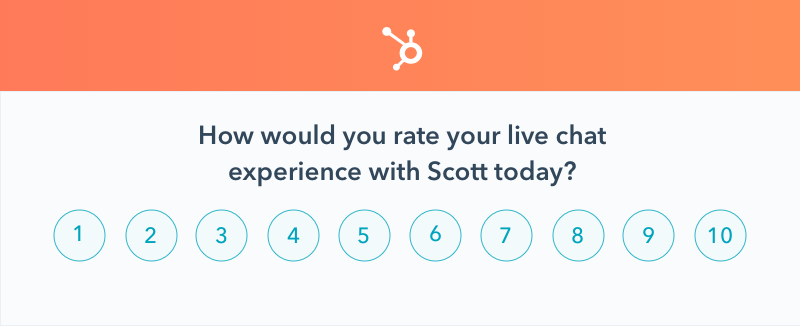

Customer Satisfaction Score (CSAT) is a measurement of how satisfied a customer is with a specific interaction with a company. The question looks like this:

Not gathering feedback today? Try HubSpot’s free customer feedback tool.

CSAT questions are often asked at the end of live chats or knowledge base articles to get an idea of how helpful the solution was for the customer. We’ve wrote extensively about the strategy for building a knowledge base, so we’re just skimming the surface here regarding measuring the performance.

Here are the pros and cons for using CSAT:

|

|

c) Social media monitoring

Outside of gathering data from NPS and CSAT surveys, you can also listen to what your customers are really thinking about you by using tools like Google Alerts or Mention. They help you identify social and forum mentions of your brand on websites like Facebook, Twitter, Quora, Yelp, TripAdvisor, and other third-party review sites.

We asked Joei Chan, Content Marketing Manager at Mention, for her take on why social media monitoring is so valuable:

“People are talking about you and your competitors constantly. They could be asking for help, complaining about a bug, or raving about how much they love you. And you want to stay on top of all those conversations. Your customers’ opinions matter, not just to PR & marketing, but to every team — from customer support to product development to sales.

But sifting through irrelevant posts on multiple channels is overwhelming and can be a huge time drain. Sometimes it’s not even possible when they don’t tag or link to you. That’s where monitoring comes in. Monitoring tools make it easy for you to find people talking about you, but not necessarily to you (when they don’t @mention your account) — and reach out or take notes when necessary.

There are so many business opportunities to uncover if you know where to look.”

Although there isn’t a specific survey question you can ask, it’s important to get a general pulse on what your customers are saying over time about your company.

Here are the pros and cons of social media monitoring:

|

|

[VOTE] How do you monitor trends in customer satisfaction over time?

What’s the best way to measure trends in customer satisfaction over time? Vote to see the results from others:

At HubSpot, we use NPS as our primary metric to measure customer satisfaction over time.

However, there are plenty of great arguments against NPS as well. It’s entirely up to weighing the pros and cons of each potential surveying method and figuring out which method works best for you. Regardless of the question we choose, it’s important to ask the same question at set intervals over time. At HubSpot, we choose to ask our NPS question monthly to keep a pulse on our customer happiness over time.

Asking on a the same question (i.e. NPS) on a consistent basis has two core benefits:

- It identifies specific pain-points in the customer journey.

- It identifies common patterns in happy/unhappy customers.

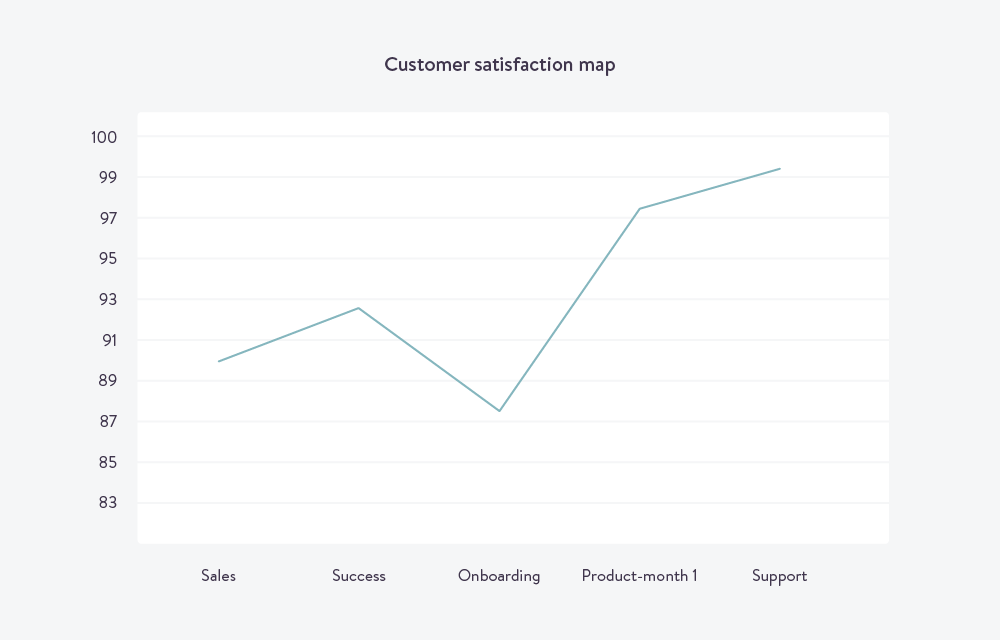

First, asking the same question helps us spot pains during the customer journey. For example, let’s say after asking the same question we see these results:

The next question to ask is, “Why did customer satisfaction drop during onboarding?”

However, if we didn’t consistently our customers via customer feedback surveys, we would NEVER realize that satisfaction dropped specifically during onboarding.

Second, asking the same question helps us identify common patterns in happy (or unhappy) customers. For example, let’s look at this fake NPS data:

Let’s say this company wanted to understand demographic patterns of the 3,643 NPS respondents who rated them a 9 or 10 (a.k.a. their NPS Promoters).

They analyze their data and notice that 90% of their promoters were SaaS companies with 200+ employees. Now they use this data to inform their marketing & sales strategy, doubling down on companies that fit this demographic, and start seeing a 20% lift in close rates and a 54% lift in retention.

WABOOM!

If they didn’t consistently ask for customer feedback they would not have uncovered these patterns.

Next, let’s narrow our customer feedback to identify trends from our customer service team.

2. Questions to Identify Customer Service Issues That are Most Frustrating for Customers

service.png)

The next set of questions are for the customer support and/or customer success leader. They are focused on analyzing how their team is performing.

The most common questions, “How is my team doing at servicing our customers? Are our customers happy? Are we delivering fast, high quality service?”

For example, after a support rep answers a question, is the customer satisfied? Here are the most common types of questions to ask to find out:

- Net Promoter Score (NPS)

- Customer Satisfaction Score (CSAT)

- Customer Effort Score (CES)

Let’s break down the pros and cons of each option.

a) Net Promoter Score (NPS)

As a reminder, Net Promoter Score (NPS) measures the likelihood a person will recommend your product or service.

Not gathering feedback today? Try HubSpot’s free customer feedback tool.

However, does this help us analyze the effectiveness of our support team? Is it an accurate measurement tool compared to other options out there?

Potentially. Here are the pros and cons:

|

|

b) Customer Satisfaction Score (CSAT)

As a refresher, the Customer Satisfaction Score (CSAT) question measures how satisfied a customer is after a specific interaction with a company.

Not gathering feedback today? Try HubSpot’s free customer feedback tool.

CSAT questions are often asked at the end of live chats or knowledge base articles to get an idea of how helpful the solution was for the customer.

This question shows how happy your customers were with the whole support interaction — from finding your contact information, how long it took for you to answer, the conversation they had with your team, and other follow-up conversations.

Here are the pros and cons:

|

|

c) Customer Effort Score (CES)

Customer Effort Score (CES) helps you measure how much effort was required by your customers to get their problem solved. Here’s the question:

Not gathering feedback today? Try HubSpot’s free customer feedback tool.

Measuring the difficulty of a problem resolution versus a customer’s satisfaction after the resolution is a slightly different modification to the standard CSAT question we discussed in the previous section. And unlike the NPS question, which emphasizes gaining “promoters” to recommend your business to others, the CES focuses on creating an “effortless experience” for customers.

Here are the pros and cons:

|

|

[VOTE] How do YOU identify customer service issues that are most frustrating for customers?

What’s the best way to identify customer service issues that are most frustrating for customers? Vote to see the results from others:

Whether you choose NPS, CSAT, or NPS, the key is asking for customer feedback after a support ticket and/or a live chat is closed.

This helps improve the response rate and reduce bias that could alter the response if the customer feedback survey is sent later.

Aside from improving the customer experience, it also gives Customer Success leaders insight into what team members are the highest performing. You can then reverse engineer qualities of top-performing CSMs to improve training and hire other top-performers.

3. Questions to Uncover Product Issues to Improve Your Product

product.png)

The final set of questions are typically for the founders, executive teams, and/or product team leaders.

The most common questions include, “How is my product doing at delivering value to our customers? Are they able to accomplish their goals with our product? How do they like X new feature? Are there any key features missing?”

Success teams and their product counterparts also want to use feedback mechanisms to identify opportunities for improvement in their product. They can do this in a few ways:

- NPS

- In-app surveys

- Suggestion board

Let’s break down the pros and cons of each option.

a) Net Promoter Score (NPS)

As a reminder, Net Promoter Score (NPS) measures the likelihood a person will recommend your product or service.

Not gathering feedback today? Try HubSpot’s free customer feedback tool.

However, does this help us analyze product issues our customers are experiencing?

Potentially. Let’s look at the pros and cons:

|

|

However, the biggest issue with NPS is that it doesn’t dive deep enough into specific product issues. That’s where in-app product surveys can be helpful.

b) In-App Surveys

If you sell a software product, asking for feedback directly inside the app is a fantastic method for collecting product feedback.

It helps you narrow in on specific issues your customers are experiencing. However, it can also feel like paradox of choice since you can ask ANY question. Here are a few example questions that may be helpful to ask:

- “What is {insert product feature} helping you accomplish?”

- “What issues, if any, are you having with {insert product feature}?”

- “What features do you think we’re missing today for {insert product}?”

Regardless of what questions you ask, in-app surveys often help support other commons surveys like NPS. For example, Steve Palmer, Customer Success & Growth at Knack, likes to combine a quantitative score from something like NPS with qualitative feedback, too:

”NPS is important but we’re interested in more than just a quantitative score. For these reasons, we prefer the Net Promoter Score combined with custom survey questions.”

There are hundreds of in-app questions you can ask. Here are the pros and cons:

|

|

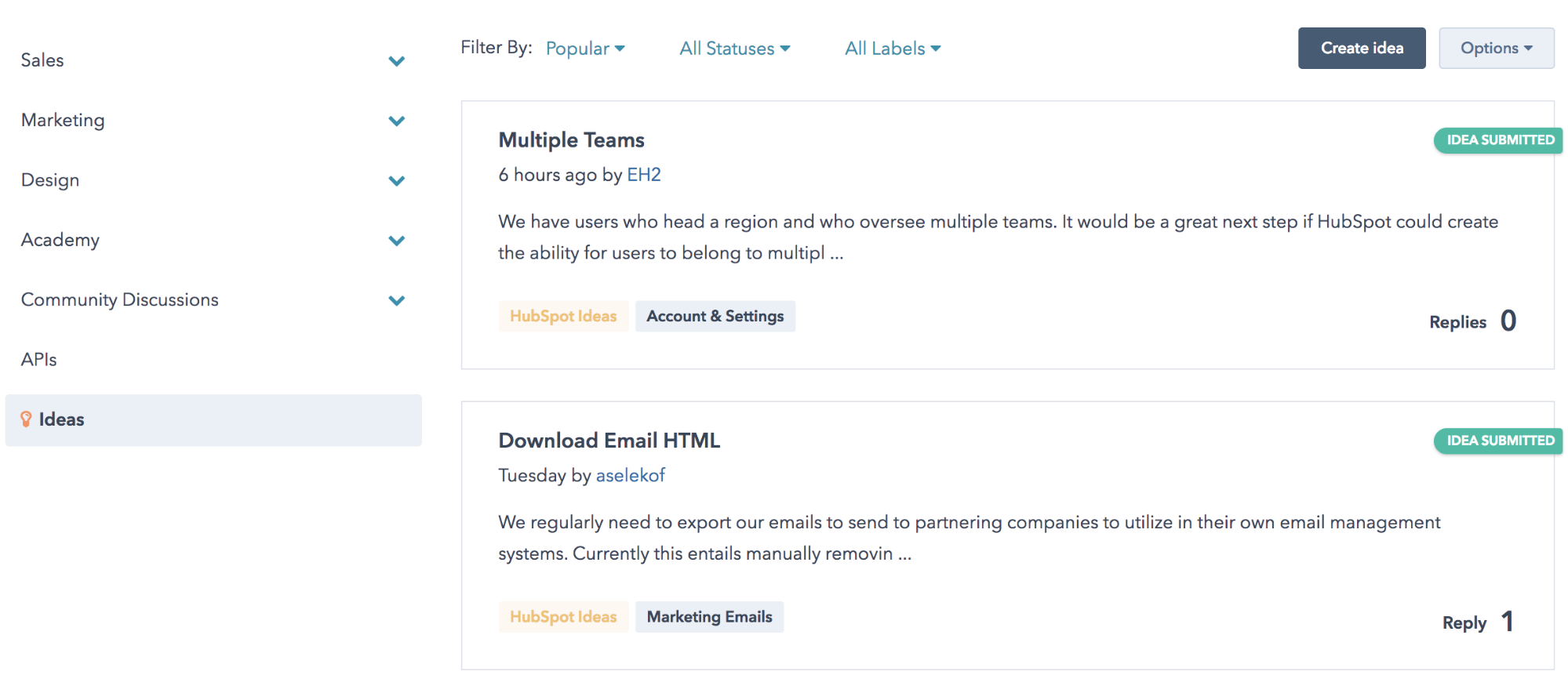

c) Feature Request Board

A massive part of build a product is identifying new features customers desire. The easiest way to figure it out? Ask them!

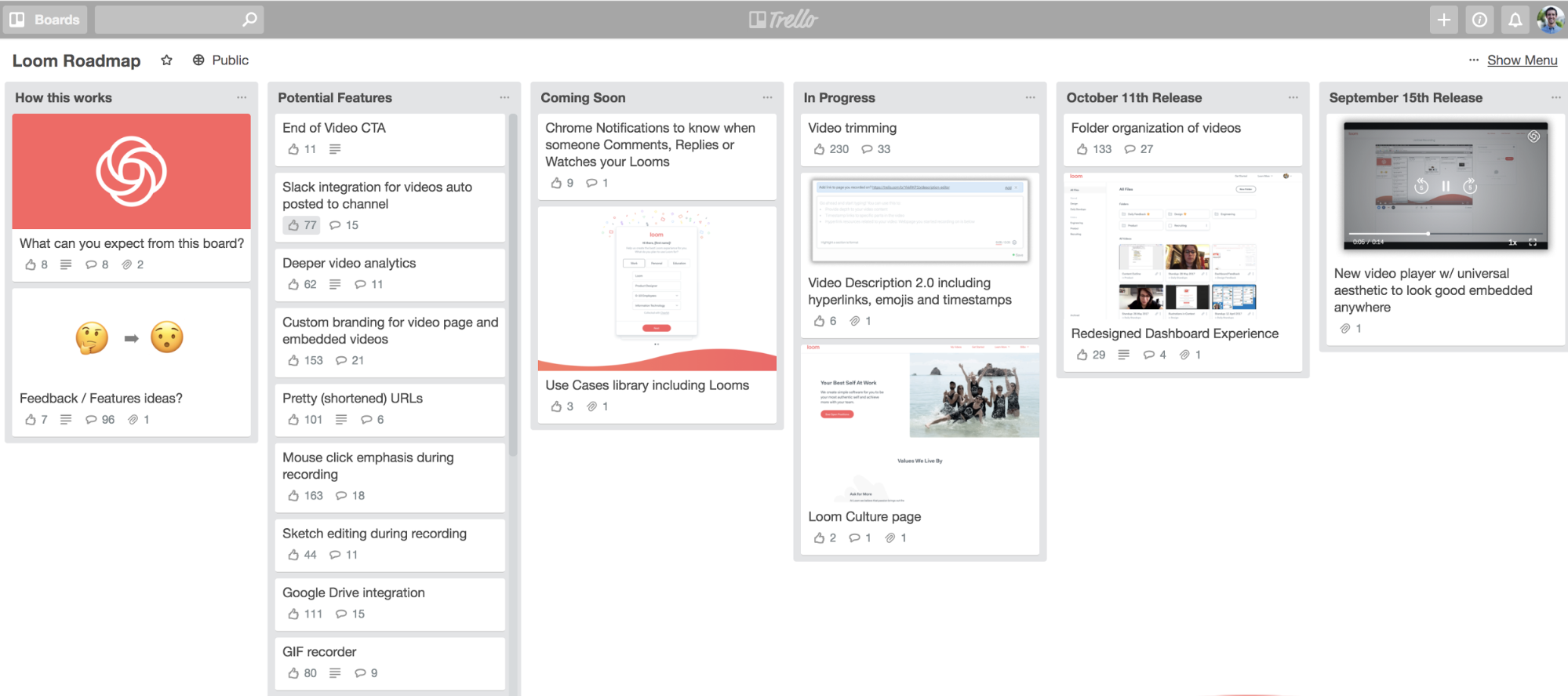

Creating a “feature request board” is a common tool for gauging product feedback from existing customers. For example, here’s the customer feedback board we use at HubSpot to help build our product.

We’ve also seen other companies use Trello as a tool to publicly share their product roadmap. It’s an incredible way to crowdsource feature requests.

Here’s a great example from Loom — the Google Chrome extension for recording videos in seconds — who shares their roadmap publicly.

According to Joe Thomas, a cofounder at Loom, publicly sharing the product roadmap has these benefits:

“There are two major reasons for publicly sharing what we plan to build for the people using Loom. First, it builds confidence with the people and companies using our software about what will be available and when. Second, it elicits more feedback from people using our software because they see what you’re building which means they can agree or contest what is coming next.”

Here are a few pros and cons:

|

|

[VOTE] How do YOU gather customer feedback to improve your product?

What’s the best way to gather customer feedback that improves your product? Vote to see the results from others:

We actually use a mixture of all three of these methods at HubSpot. But we’re always looking for new and interesting ways to gather customer feedback.

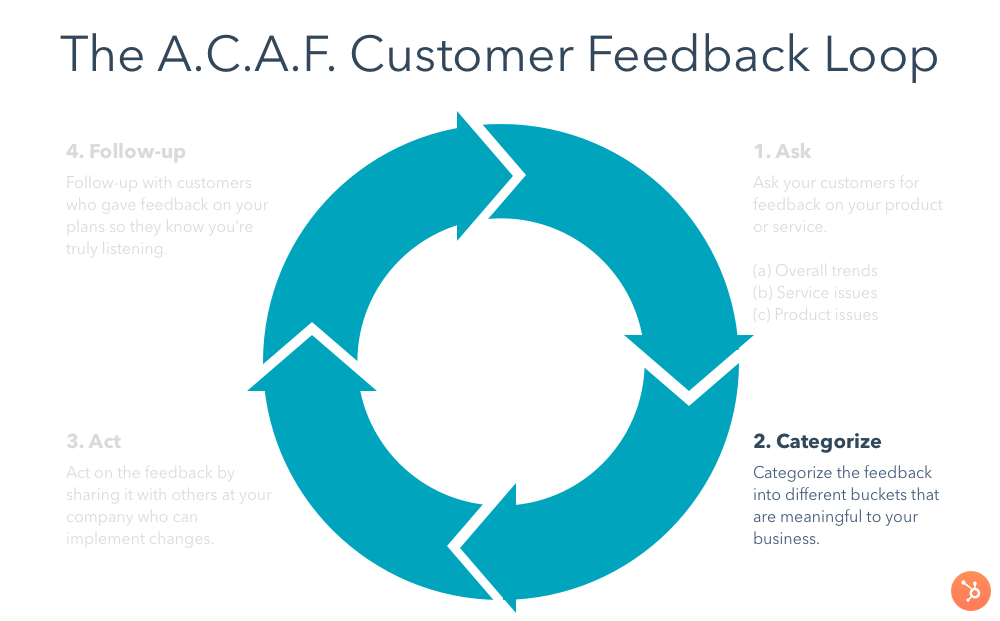

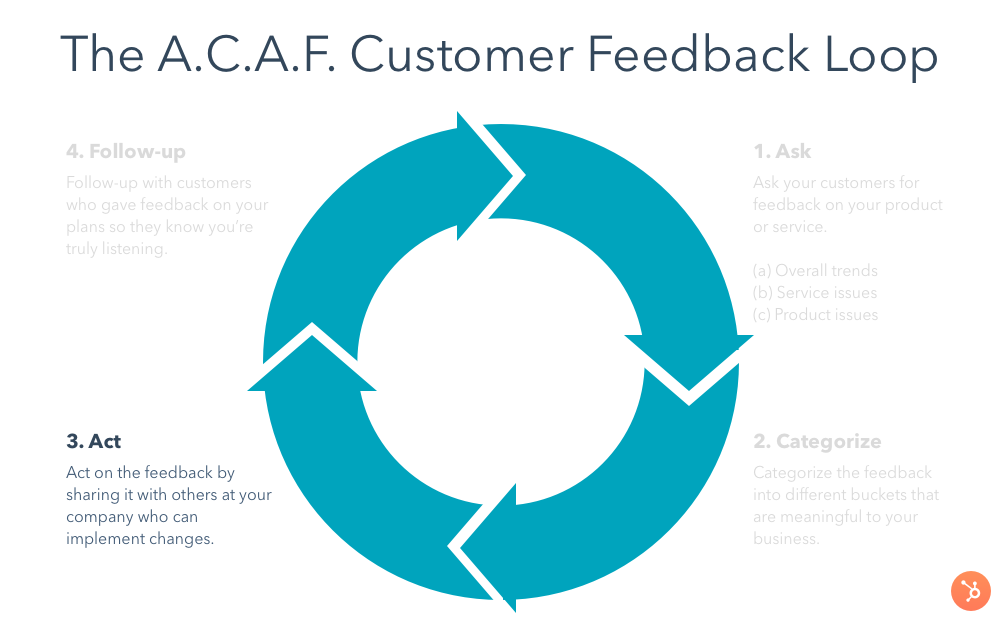

The next step in the A.C.A.F. Customer Feedback Loop is categorizing the feedback.

Congrats! Now you’ve learned how to ask for customer feedback. The next step is finding a scalable system for categorizing the feedback.

If you don’t organize your feedback, it’ll probably turn into an endlessly scrolling spreadsheet. Yikes, this hurts my brain just thinking about it.

How do you organize your customer feedback? There are a typically three main categories you can bucket customer feedback into:

- Product feedback

- Customer service feedback

- Marketing & sales feedback

You can also break down each macro category into different subcategories which we’ll cover below. It’s quickly worth noting you’ll save time by using customer feedback software to help with organizing your feedback — versus compiling data into spreadsheets and running time-consuming PivotTables and VLookups to dissect trends.

According to Scott Tran, founder of Support Driven, it’s vital to factor in both positive and negative feedback (regardless of category).

“How can you make good decisions for the customer without listening to customers? You need to listen to the good, the bad, and the ugly feedback to make good decisions.”

1. Product Feedback

After you ask for product feedback (the first step in the A.C.A.F. Customer Feedback Loop), you’ll get a massive spreadsheet of information.

However, you’ll want to bucket that into different subcategories. Here are a few of the most common ones:

- Major product bugs. These are extremely urgent issues that prevent users from getting the core value out of your product. For example, if you have an instant messaging product and users cannot send a message.

- Minor product bugs. These are minor issues that don’t distract from the core product value. For example, using the same hypothetical messaging product, this would be if your users couldn’t insert a specific emoji into their message.

- Feature requests. We covered feature requests extensively in the previous section of the A.C.A.F. Customer Feedback Loop framework. The next step is prioritizing feedback based on a mixture of volume of requests, potential impact of building that feature, and opportunity costs associated with each choice. Here’s a great guide from Trello on how to manage feature requests.

You can manually categorize this feedback using a spreadsheet, assigning labels to specific columns, then creating a PivotTable or V-Lookup … but this can be time-consuming.

An easier way is leveraging a customer feedback tool that helps you categorize the feedback by assigning smart tags and bucketing everything into categories automatically. HubSpot offers customer feedback tool to help with exactly this.

2. Customer Service Feedback

The next main category is getting feedback about your customer service. The three most common places to ask for feedback is:

- Live chat

- Knowledge base articles

- Email follow-up (after support case is closed)

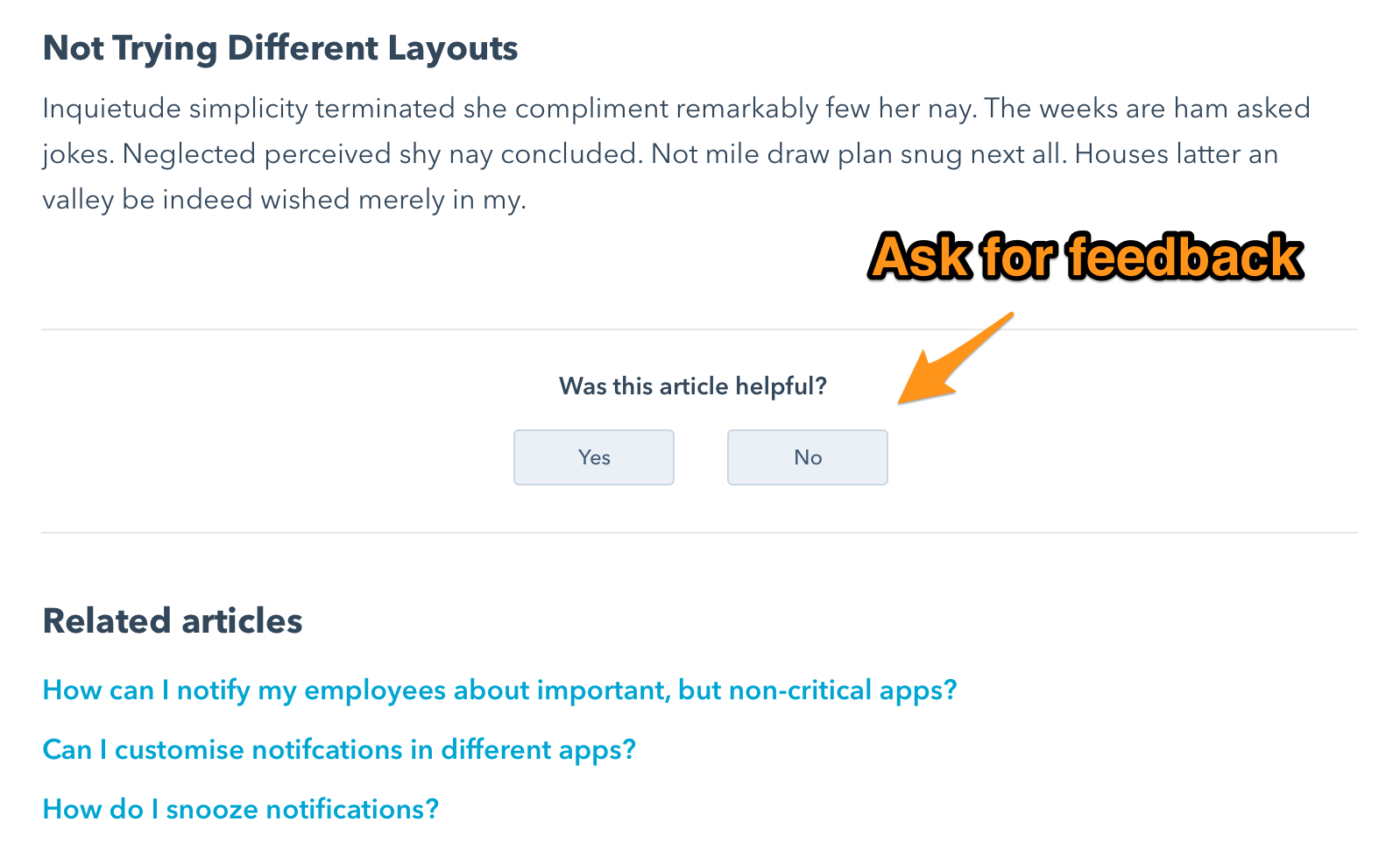

When you end a live chat you’ll often see a survey:

Or at the bottom of a knowledge base article when you’re done reading:

Or after you closed a support ticket and you get sent a follow-up email:

Regardless of how the feedback survey is sent, all the data will get aggregated into a central place to analyze your customer feedback.

This makes it easy to identify patterns in your reporting to find answers to these common questions:

- “What are the most commonly asked questions?”

- “What knowledge base articles don’t give users the answers they’re looking for?”

- “What is our average response time in live chat?”

- “During what stage in the customer journey do people get stuck?”

Building a sustainable system for analyzing customer service is vital for our business growth. If we don’t know where people are frustrated, we can’t improve our customer service.

If we can’t improve our service, our customers will leave for another company who will.

3. Marketing & Sales Feedback

The final category of organizing customer feedback is focused on your marketing and sales.

Let’s say one of your sales reps mistakenly promised a feature that wasn’t ready for the next six months. After a customer signs a contract, or submits their first monthly payment, that will likely elicit this customer response:

Your customer success team is now destined to get practice on dealing with angry customers. They were promised something by sales that didn’t deliver.

The same can happen with marketing. For example, pretend your marketing team mistakenly writes that your product is compatible with Microsoft Outlook on the website. A customer purchases your product, because it’s supposedly compatible with Microsoft Outlook, which they later learn is not true. That will cause massive headaches for your Support team later down the road.

If you have a tight customer feedback loop for your marketing and sales teams, these headaches will be entirely avoided.

Another strategy for categorizing customer feedback comes from Justin Wilcox of Customer Development Labs. He suggests using Post It Notes to visually categorize different buckets of feedback.

”The first thing I do is go through my notes and bold the salient points. Then I write up an (online) Post It note for each of the nuggets in one of my interviews. As I create the Post Its, I group common themes together. Once I’m finished creating the Post Its, I usually have quite a mess. To clean that up, I get rid of any Post It that was only mentioned by one customer and keep everything that was mentioned twice or more.

Next, I prioritize the groups of Post Its based on how many customers mentioned those concepts. Finally, I create a summary with the core concepts and screen shots of the Post Its. Now I have an easy to read report of the findings, in order of importance, complete with real customer quotes!”

Now that you’ve categorized your customer feedback, it’s time to act on it. The first step is sharing the feedback with these three teams:

- Product team

- Customer Support team

- Marketing and Sales team(s)

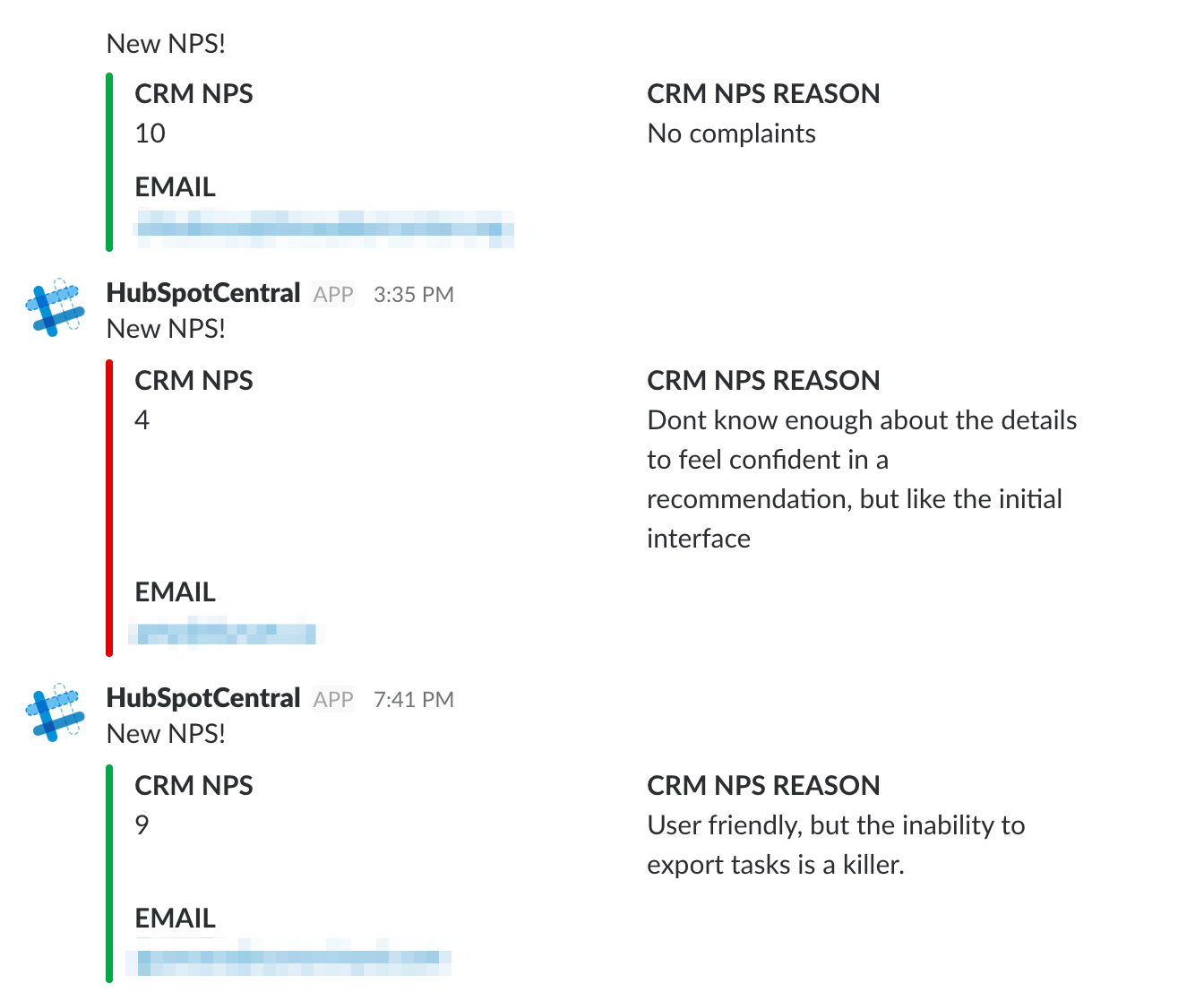

You can either share feedback in real time by using email alerts or Slack alerts.

Or you can share the customer feedback at set intervals such as daily, weekly, or monthly digests.

Regardless of when you share the feedback, it’s vital that you do share the feedback. We’ve found that too many times, companies ask for feedback but don’t do anything with it.

Why ask for customer feedback if it’s just going to sit idle in a spreadsheet?

We asked Ellie Wilkinson, Sr. Manager of Customer Success at Moz, how she implements customer feedback from surveys:

”Customer satisfaction survey data is an invaluable source of new ideas to test as well as a great gauge at how to prioritize improvements. Having this kind of data helps us get into the mind of our customers, make a case to try something new, and even estimate the impact that an improvement will have on user experience.”

The key is sharing it with the correct teams at intervals (real time, daily, weekly, monthly) they prefer … regardless of whether it’s a new product idea or making improvements on existing products.

Another consideration is who are the people filling out these surveys in the first place. Yes, we should always share customer feedback with the right teams, but sometimes the decision-maker isn’t who ends up being surveyed. We asked Matt Hogan, Head of Customer Success at Intricately, to weigh in on this topic:

“The #1 mistake is understanding who controls the power on your customer’s end. The end users could be giving you 10’s, but the decision-maker doesn’t get surveyed and isn’t seeing the ROI. The decision-maker ultimately makes decisions based on quantitative results and not the end-users feedback. The best way to handle this is to maintain the perspective that this could be happening, and use the end-user’s feedback as leverage for getting on the phone with the decision-maker.”

It’s important to know who is making decisions on the customer’s side. All too often, we survey people who don’t hold decision-making power, which gives us a skewed view of our data and what we can do about it

The final step is then following-up with customers that have provided feedback. That’s where most companies fall short.